2022 in 10 minutes

Want to make sense of 2022, but don’t have much time? Or simply want to start with the top-line view? We’ve painstakingly whittled down the report to the most fundamental and useful findings of the year, so that you can peruse the highlights reel in just 10 minutes.

Macro risks realised

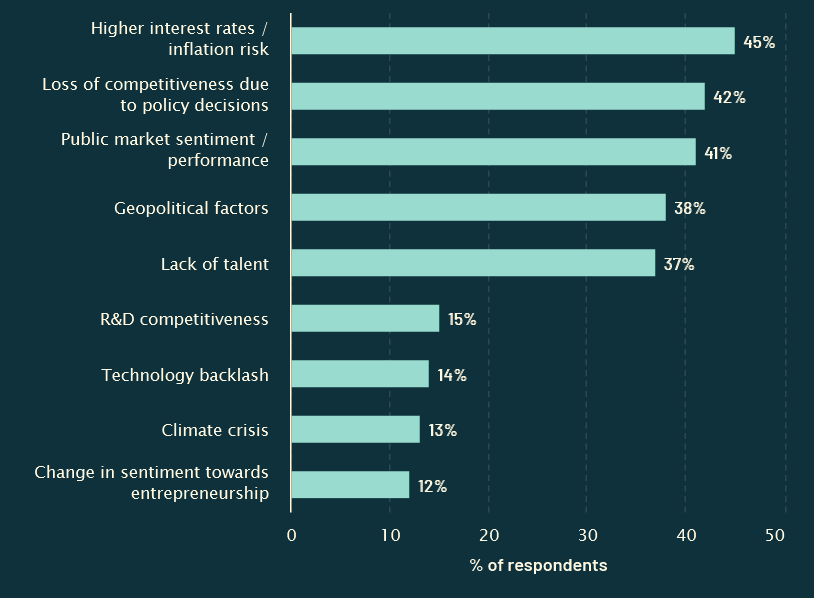

In last year’s survey, respondents were asked to highlight the main macro risks that could lead to a slowdown in European VC activity over the next five years. Many of the macro risks that ranked highest amongst respondents – interest rates, inflation, geopolitics, and public market sentiment – have all become defining hallmarks of this year. As a consequence, 2022 has been a very different year for the European tech ecosystem.

What are the three main macro risks that you see that could lead to an overall slowdown of VC activity in Europe over the next 5 years?

A tale of two halves

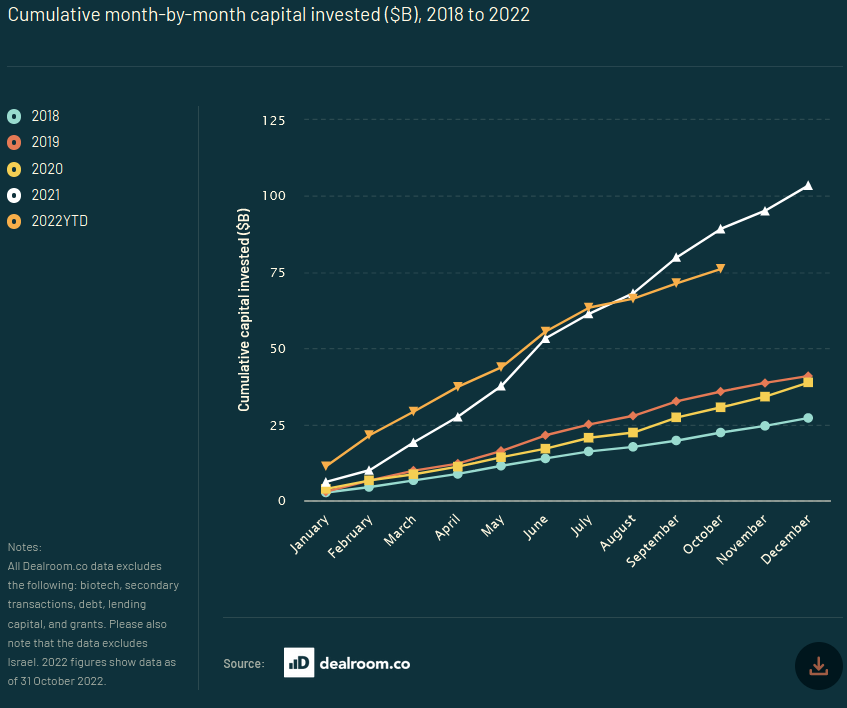

The tale of 2022 has been one of two halves. The record-breaking level of investment activity that defined 2021 carried over into 2022. In fact, by the end of the first quarter of 2022, investment levels were tracking a staggering 52% up from 2021. Even at the end of the first half of the year in June, total capital invested still stood around 4% higher than at the same point last year.

July, however, marked the month when the investment frenzy of the past 18 months started to cool off. This slowdown really took effect through August and September and has seen monthly investment levels drop closer to levels last seen in 2018, at around $3-5B invested per month. As a consequence, total investment in Q3 2022 ended up down more than 40% compared to the same quarter in 2021.

Total investment levels will hit around $85B

2021 was a remarkable year for the European tech ecosystem with total investment eclipsing a landmark $100B for the first time. 2022, unsurprisingly, is on track to fall short of 2021’s record-breaking levels, but only by a relatively small margin.

Given the material slowdown experienced over the summer, a conservativeestimate would be just around $85B for the full year, as it accounts for actuals up to end of October and annualised on the basis of average investment amounts between the three months of August, September, and October.

It ought to be said: this is the largest amount ever invested in the European tech ecosystem, apart from last year. It does represent a year-on-year decline of 18% – but in the face of the toughest macroeconomic environment since the Global Financial Crisis, such a minimal decrease is a noteworthy outcome.

Read more here:

https://stateofeuropeantech.com/reading-tracks/reading-track-resilience1